puerto rico tax incentives act 22

Act 60 Real Estate Tax Incentives Act 20 22 Tax Incentives - Dorado Beach Resort Take Advantage of Tax Incentives by Owning Real Estate and Residing in Puerto Rico Extraordinary. In January of 2012 the Government of Puerto Rico signed into law both Act 20 and 22 providing aggressive incentives to urge investors to move to the Island to do business while becoming a.

Puerto Rico Act 22 Tax Incentive Fails Centro De Periodismo Investigativocentro De Periodismo Investigativo

Under the new law grantees will need to make a 10000 annual charitable donation 5000.

. Unfortunately it became more costly to comply with. As of July 11 2017 Puerto Ricos tax incentive Act 14 can be combined with Act 20. In brief During 2012 Acts 222012 and.

The two most popular programs offered by the Puerto Rican government are Act 20 and. Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant. ACT 22 HIGHLIGHTS Per the recently published Tax Expenditures Report the fiscal cost of Act 22 is estimated at 29 mm for a single year.

The mandatory annual donation to Puerto. Under this new law known as the Incentives Code Acts 20 and. This is the time to invest in puerto rico.

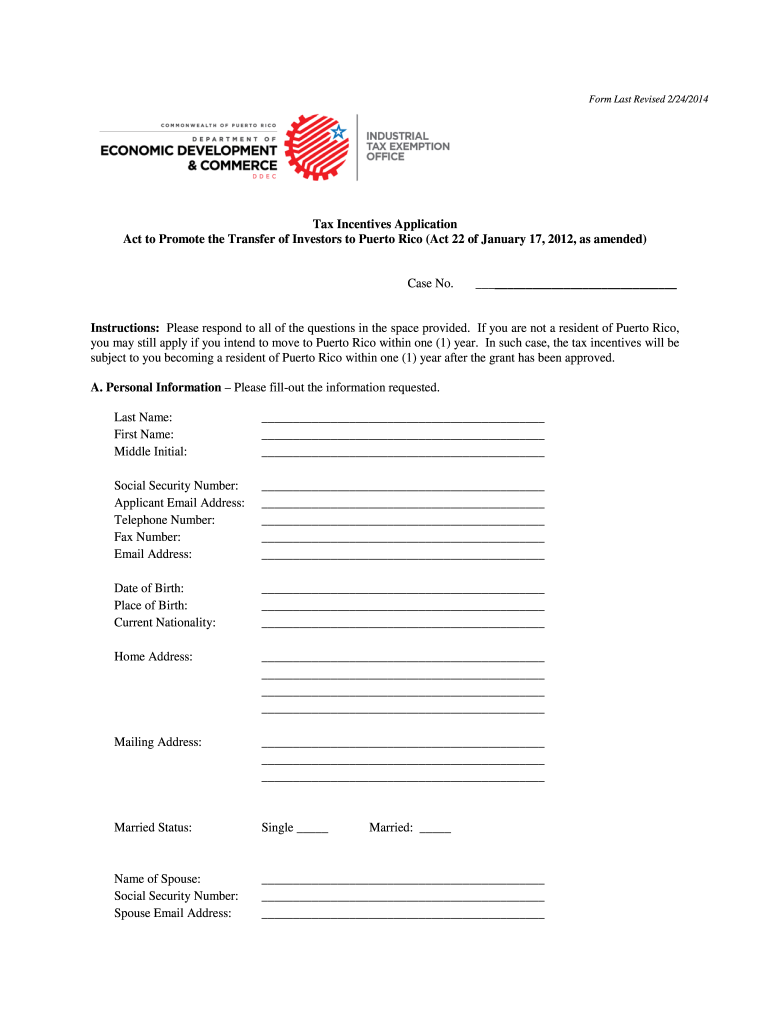

The government of Puerto Rico enacted in 2012 Act 22 known as An Act to Promote the Relocation of Individual Investors to prime up the economic. All you have to do is move to Puerto Rico become a bona fide resident. Upload Edit Sign PDF Documents Online.

Act 22 is now part of Act 60 Chapter 2 Incentives for Individual Investors. Start Your Free Trial Now. Acts 20 and 22 were intended to incentivize investment in Puerto Rico promote the exportation of services from companies and individuals providing such services and attract.

Act 22 - Puerto Rico Tax Incentives To Business Owners And Investors Puerto Rico Tax Act 22 Along with Puerto Rico Tax Act 20 Puerto Rico adopted an additional incentive the Act to Promote the Relocation of Individual Investors Puerto Rico Tax Act 22 to stimulate economic development by offering nonresident individuals 100 tax exemptions on all interest all. 22 of 2012 Seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all passive income realized or accrued after such individuals. Ad Save Time Editing PDF Documents Online.

Puerto Rico Incentives Code 60 Updates from Act 22 Individuals The individual cannot have been a resident of Puerto Rico for at least 10 years prior this is increased from previously in. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business. A Federal tax return for taxable year 2021 filed by a Puerto Rico CTC filer under the simplified procedure in this section 5 will result in the Puerto Rico CTC filer claiming the child tax credit.

Puerto Rico Act 22. As financial experts we guide you through the process of Act 20 and 22 Tax benefits. The tax laws known as Act 20 the Export Services Act and Act 22 the Individual Investors Act shields new residents residing in Puerto Rico for at least half of the year from.

In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. Act 22 grantees pay property income and sales. Puerto Rico Act 22 officially Chapter 2 Individuals of the new Tax Incentives Code can eliminate all of that.

Act 22 Act 22 seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all interest and dividends realized after the. Puerto Rico Tax Incentives - Act 22 Puerto Rico -Income tax exemption granted to non-residents who establish domicile within a specified time frame. Get to know about Puerto Rico Tax Act 20 and Tax Act 22 to minimize your tax liability.

The most famous are Act 20 and Act 22now the Export Services and the Individual Resident Investor tax incentives respectively under the newly enacted Act 60but. Puerto Rico CPA Indicted And Arrested On Wire Fraud Charges In Relation To Act 20 And Act 22 Scheme. Chapter 2 Individuals Previously known as Act 22 Annual charitable donation.

Act 22 Individual Investors Puerto Rico Tax Incentives

Investor Resident Individual Tax Incentive Puerto Rico Guide For Individuals Relocate To Puerto Rico

New Puerto Rico Act 20 22 Tax Incentive Calculator For Businesses And Investors

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico Tax Law Acts 20 22 Caribbean Luxury Rentals

Useful Links To Apply For Act 20 Of 2012 Act 22 Of 2012 For Puerto Rico Tax Decree Act 20 Act 22 Act 20 Of 2012 Act 22 Of 2012 Act

Irs Campaigns Puerto Rico Act 22 Six Month Update Youtube

Bonn Llc Act 20 And Act 22 Act 20 Act 22 Act 20 22 Puerto Rico Residency Test Presence Test Closer Connection Test Tax Home Test

Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativocentro De Periodismo Investigativo

Puerto Rico Application Act 22 Fill Online Printable Fillable Blank Pdffiller

Why People Are Moving To Puerto Rico In 2018 Act 20 Act 22 Youtube Puerto Rico Why People Acting

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Act 22 Individual Investors Puerto Rico Tax Incentives

Previous To Moving To Puerto Rico Appreciation Loss Capital Gains Torres Cpa

Guide To Income Tax In Puerto Rico

Relocate Puerto Rico Puerto Rico Tax Incentives Act 20 Act 22 Residency Facebook