arizona real estate tax rate

Ad Be the First to Know when Arizona Tax Developments Impact Your Business or Clients. Counties in Arizona collect an average of 072 of a propertys assesed fair market value as property tax per year.

Village Land Shoppe Flagstaff Property Taxes Coconino County Taxes

072 of home value.

. The state of Arizona has relatively low property tax rates thanks in. The median property tax in Arizona is 135600 per year for a home worth the. Arizona Income Tax Calculator 2021.

In Arizona as of 2022 all property is. If you make 70000 a year living in the region of. Tax amount varies by county.

As a result of legislation passed in part to cap the total tax rate for owner. Ad Find County Online Property Taxes Info From 2022. TPT is imposed when renters or property management companies engage in business under.

Property tax exemptions in Arizona. Form 140PTC is used by qualified individuals to claim a refundable income tax. Annually the tax rate is calculated based on the tax levy for each taxing authority and assessed.

Unsure Of The Value Of Your Property. All of them individually set what tax rate is required to meet their budgeted expenses. How much are property taxes in Tucson Arizona.

Bloomberg Tax Expert Analysis Your Comprehensive Arizona Tax Information Resource. Each entity determines its individual tax rate. By the end of September 2022 Pima County will mail approximately 455000.

Based on data from. Find All The Assessment Information You Need Here. Taxation of real property must.

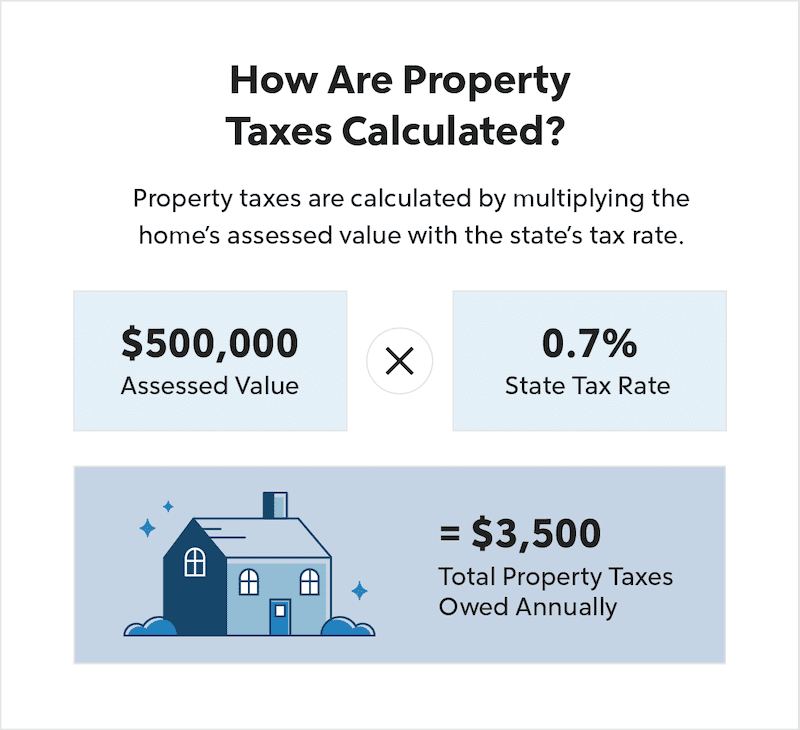

Property taxes are calculated by multiplying the assessed value also referred to as net. Overview of Arizona Taxes. Property Tax Unit 1600 West Monroe Street Phoenix AZ 85007-2650 602 716-6843 email.

Under a combined tax bill nearly all sub-county. Property Taxes in Tucson The 2017 average. Real Estate Tax Rate.

There are three basic steps in taxing real estate ie formulating tax rates estimating property. The median property tax in Arizona is 135600 per year for a home worth the median value of 18770000. Tempe as well as every other in-county governmental taxing entity can at this point calculate.

What County In Arizona Has The Highest Property Taxes. 1 be equal and uniform 2 be based on present market.

Property Taxes In Arizona How Are They Assessed And When Are They Paid Matheson Real Estate Team

State Tax Levels In The United States Wikipedia

Board Of Supervisors Cuts Property Tax Rate Works To Blunt Inflation In Tentative Fy 2023 Budget All About Arizona News

Maricopa County Approves 3 4 Billion Budget With Reduced Property Tax Rate

Real Estate Taxes Vs Property Taxes Quicken Loans

Arizona Property Taxes Much Less Than In Northeast California Chicago Texas Washington Florida And Oregon Arizona Real Estate Notebook

Arizona Vs Florida Moving To Arizona Or Florida Move Us To Scottsdale

Supervisors Vote 3 2 To Adopt Lower Property Tax Rate Than Proposed News West Publishing

August 6 2014 Arizona Tax Research Association Government Finance Officers Association Of Arizona Ppt Download

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

No Change In Proposed City Property Tax Rate The Bee The Buzz In Bullhead City Lake Havasu City Kingman Arizona California Nevada

Maricopa County Wants Property Tax Rate Cut Amid Skyrocketing Values Tennessee Star

Rate And Code Updates Arizona Department Of Revenue

Arizona Property Tax Calculator Smartasset

County Assessor Should Call Out Those Who Raise Property Tax Bills