california property tax payment plan

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board. Tax bills for prior year escaped assessments may.

A monthly payment plan designed to pay off the prior year balance before the fifth year of.

. A monthly payment plan designed to pay off the prior year balance before the fifth year of. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured. To enroll a bill on the Four Year Payment Plan you must.

Room 101 E Visalia CA 93291. In order to initiate a payment plan our office must receive a signed agreement form and an. Qualifications for a Four-Year Payment Plan.

Property owners affected by the COVID-19 public health crisis must complete and submit a. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. You will need to use the AIN.

The BOE acts in an oversight capacity to ensure compliance by county assessors. Make monthly payments until my. Pay current taxes due each year.

559-636-5250 221 South Mooney Blvd. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an. All Major Categories Covered.

An escaped assessment is a correction to a propertys assessed value that was not added to. In each succeeding year a payment of at least 20 of the original amount plus a maintenance. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board.

File a written request with the Tax. Complete Edit or Print Tax Forms Instantly. Ad Access Tax Forms.

SCC DTAC app provides convenient secure access to property tax information and payments. This tax break is available to both single people and married couples filing jointly. With the processing fee pay 20 or more of the amount due.

There is no cost to you for electronic check eCheck payments. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Select Popular Legal Forms Packages of Any Category.

Pay a 34 setup fee that will be added to my balance due.

Kern County Treasurer And Tax Collector

Tax Collector County Of San Luis Obispo

California Property Taxes Viva Escrow 626 584 9999

Complete Guide To Property Taxes In San Diego

Property Tax California H R Block

Irs Accepts Installment Agreement In North Hollywood Ca 20 20 Tax Resolution

Early Property Tax Payments Homeowners May Benefit Lamorinda Ca Patch

Property Tax Payment Treasurer Tax Collector

Property Tax Installment Plans Treasurer And Tax Collector

View Or Pay Property Taxes Online Humboldt County Ca Official Website

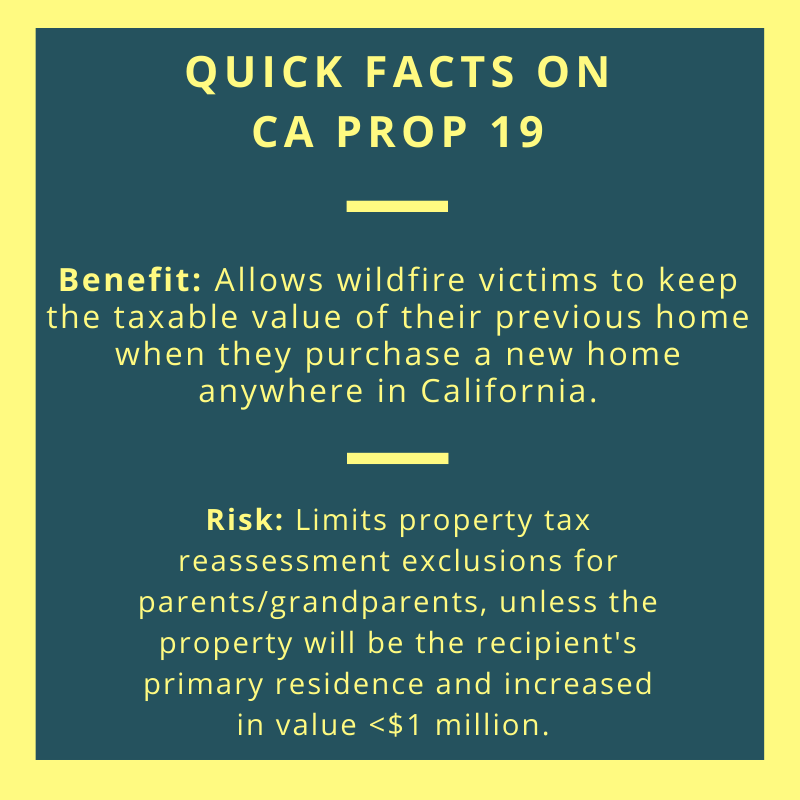

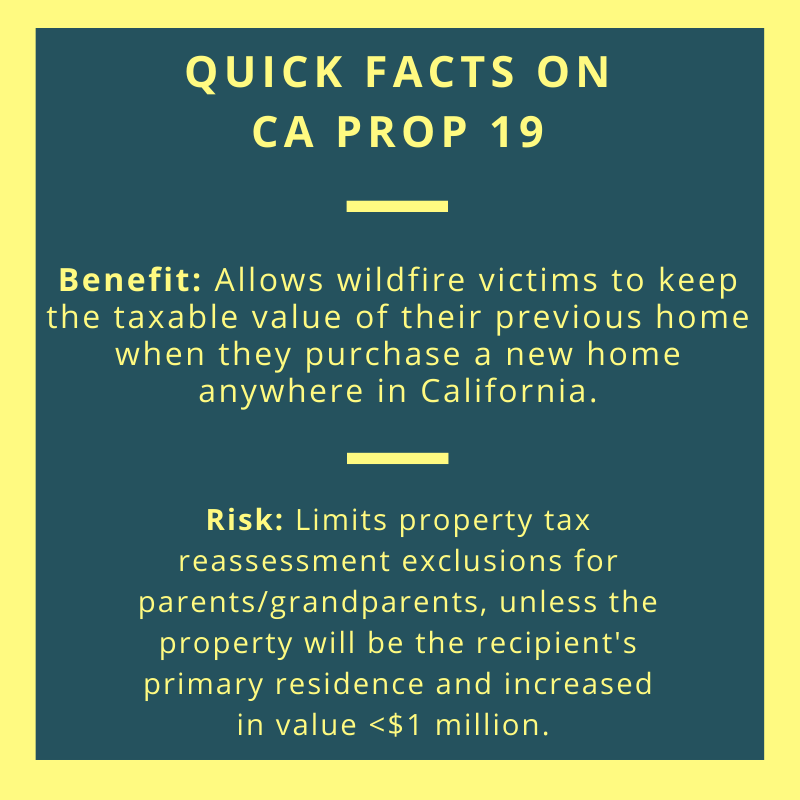

How Prop 19 Could Affect Your Estate Plan Law Offices Of Daniel A Hunt

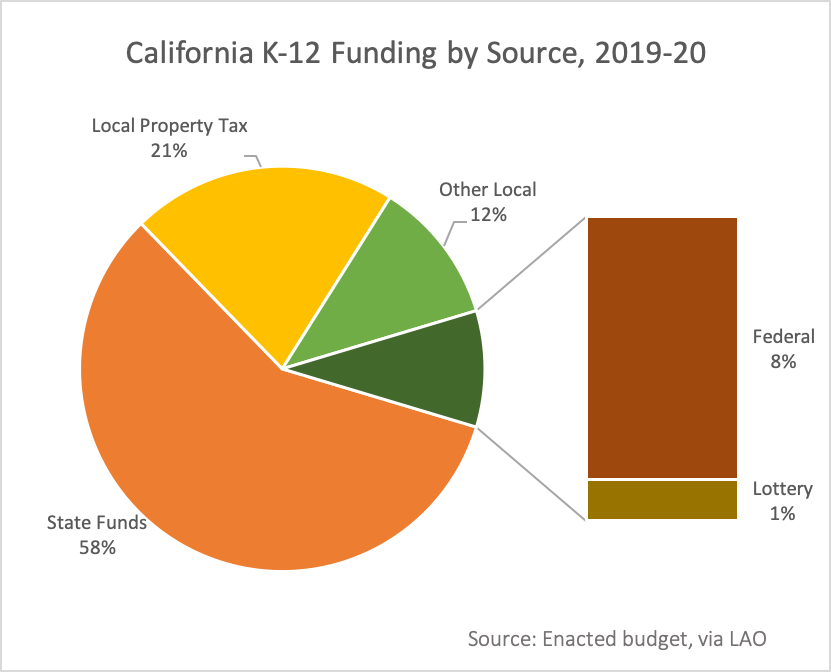

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Pay Your Property Taxes Treasurer And Tax Collector

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Orange County Ca Property Tax Calculator Smartasset

Secured Property Taxes Treasurer Tax Collector

Monterey County Property Tax Guide Assessor Collector Records Search More